Discover the most effective Hard Money Lenders to Safeguard Your Business Funding

In the realm of company financing, the search for the most suitable hard money lender can be a crucial step towards attaining your financing goals. By uncovering the best hard money lenders, you can potentially unlock opportunities that propel your business in the direction of development and success.

Advantages of Hard Money Lenders

Difficult money lending institutions supply a beneficial different financing option for businesses looking for quick access to resources. Among the main benefits of tough money lenders is the rate at which they can supply funding. Conventional financial institution financings usually include a lengthy authorization process, while hard cash lenders can review and authorize car loans in an issue of days. This fast turnaround time can be critical for companies facing time-sensitive chances or financial emergency situations.

In addition, hard cash lending institutions are usually more versatile in their borrowing criteria compared to typical monetary establishments. They are more focused on the worth of the security instead of the debtor's credit rating or economic statements. This versatility makes tough cash lendings an appealing alternative for businesses that may not receive a small business loan due to poor credit or non-traditional monetary scenarios.

In addition, hard money lenders typically supply a lot more tailored solution to borrowers. Unlike large banks, hard cash lenders are usually smaller companies that offer a more individualized approach to lending. This can result in a smoother and more efficient loaning experience for organizations seeking fast funding.

Aspects to Think About Before Selecting

When evaluating tough money lending institutions for organization funding, it is vital to meticulously take into consideration several key elements before making a decision. Examine the speed of funding offered by the loan provider. By completely taking a look at these aspects, you can pick the ideal tough cash lending institution to satisfy your service moneying requirements.

:max_bytes(150000):strip_icc()/hard-money-basics-315413_Final-cdfb8155170c4becb112da91bd673fe8-0472b1f57ff94abebddef246c221a65f.jpg)

Leading Standards for Evaluating Lenders

Evaluating lenders for organization funding needs a complete evaluation of crucial requirements to make sure an audio monetary decision. The top criteria for evaluating lenders consist of rates of interest, terms, track record, rate of approval, and client service.

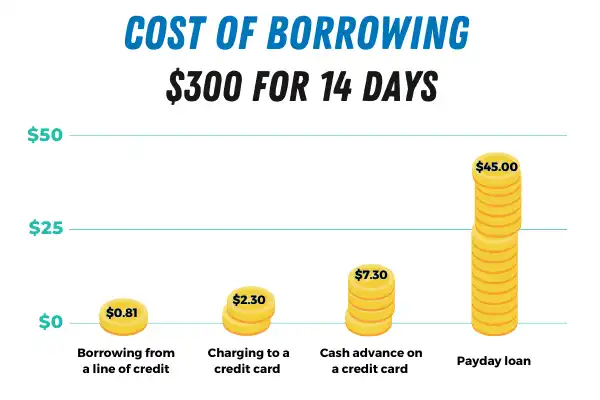

Rate of interest prices are an important element when picking a loan provider as they directly affect the cost of loaning. Understanding variables such as payment timetables, collateral needs, and any type of added charges can aid in making a notified choice.

Researching online reviews, testimonials, and the lender's track record can provide understandings right into their integrity and reliability. Reviewing the degree of consumer solution provided by the loan provider can indicate how they focus on customer fulfillment and attend to any type of issues that may emerge throughout the loaning process.

Finding the Right Lending Institution for You

To make an informed choice about choosing the appropriate loan provider for your organization funding requirements, it is necessary to consider exactly how well their solutions align with your economic goals and demands. Beginning by evaluating the loan provider's experience in providing difficult cash lendings for services comparable to yours.

Last but not least, take part in straight conversations with possible lending institutions to review your service plans, funding requirements, and any concerns you might have. Pick a lending institution that not only provides beneficial terms but additionally shows a dedication to assisting your company visit be successful. By carefully evaluating these variables, you can locate the ideal difficult money lending institution to sustain your service growth.

Safeguarding Your Organization Funding

Securing adequate financing for your business is paramount to attaining sustained development and success in the competitive market landscape. To safeguard your service funding effectively, beginning by producing a detailed organization plan outlining your business's objectives, economic forecasts, and just how the funds will certainly be utilized to drive development. This plan will certainly not only work as a roadmap for your company yet also infuse confidence in possible loan providers concerning your tactical strategy.

Next, analyze your funding requires accurately to figure out the amount needed to fulfill your company objectives. more tips here Consider aspects such as operational expenses, development plans, and any type of possible contingencies that may emerge - georgia hard money loans. Having a clear understanding of your financial needs will certainly enable you to come close to lending institutions with a well-defined funding demand customized to your specific requirements

Furthermore, explore diverse funding choices beyond standard financial institution financings, such as tough cash lending institutions, endeavor plutocrats, or crowdfunding systems. Each method supplies unique advantages and considerations, this post so pick the alternative that straightens ideal with your organization purposes and economic scenario. By expanding your financing technique, you can maximize your possibilities of securing the necessary capital to propel your business onward.

Verdict

To conclude, difficult money lenders offer numerous advantages for protecting company funding. It is essential to carefully take into consideration aspects such as rate of interest rates, terms, and reputation prior to selecting a lender. Reviewing lending institutions based on criteria like experience, adaptability, and transparency can help you discover the best fit for your service requirements. By taking the time to study and compare various choices, you can confidently protect the funding essential to support your business growth.